Not All General Liability Policies Are The Same

Two Types of General Liability: Claims Made and Occurrence

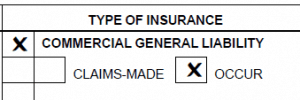

If you're a contractor or small business owner, you face plenty of risk when it comes to liability and litigation. Commercial General Liability insurance plays a key role in helping you manage these risks. But not all Commercial General Liability policies are the same. There are two main policy types: Claims-Made and Occurrence. The type of policy you have could be very important when a loss occurs.

Occurrence Coverage

Most policies are written on an occurrence basis. This means that coverage is triggered based on when an occurrence (accident or exposure to harmful condition) happened. The occurrence must happen during the policy period, but the claim can be filed at any time. This is especially important for contractors facing construction defect litigation, claims which often are filed years after work is completed.

Claims Made Coverage

With claims made policies, coverage is triggered based both when the occurrence happened and when the claim is filed.

Coverage Period - In claims-made policies the first factor in determining coverage is if the occurrence happened during the coverage period. The coverage period begins with the retroactive date and ends with expiration date of the current policy. The retroactive date can be years before the effective date of the policy, so that losses resulting from prior occurrences can be covered.

Policy Period - The second factor in determining coverage with claims made policies is when the claim is filed. The claim must be filed with the insurance company during the policy period.

So which policy is right for me?

Determining which policy is right for you has a lot to do with the kind of coverage you are already carrying. You should consult with a licensed broker or agent before switching from one policy form to another.

However, without prior coverage being a factor, you are better off carrying your general liability coverage on an occurrence policy form. While lower rates from claims made policies may be tempting, especially for new business owners, there are many risks associated with carrying claims-made coverage. Most notably, you could be left exposed in the event that an insurance carrier either non-renews your policy or goes out of business.

The major difference between the two policies is that occurrence coverage is designed to be there for you years down the road. While claims-made policies will offer “tail coverage” to address this coverage gap, these endorsements can be costly and most often outweigh the savings benefit of carrying claims-made coverage.

Manuscript coverage and other endorsements

But wait...there’s more. Not all “Occurrence” policies are the same.

Some policies disguise themselves as “occurrence form” but don’t actually provide the long-term protection one might assume when buying an occurrence general liability policy. Sunset clauses, prior work exclusions, manifestation provisions, and manuscript wording can all limit the way coverage is triggered. The best way to make sure you are not exposed for long term liability is to review your current and past policies with a licensed agent or broker.